Power Sector Emissions Have Peaked, ESG Waning and Lessons From America

In this issue:

Power sector emissions have peaked

At least according to the latest research from Ember. Its Global Electricity Report states “a new era of falling power sector emissions is close”. The report is non-committal about quite when or how quickly emissions will fall, as this will depend on government policies and their adherence to them, but the authors believe emissions have plateaued. Solar generation was up 24% in 2022 (over 2021) and wind up 17% and their share of the generation mix is set to continue growing.

Global wind energy to top 1 TW in 2023

Consistent with that is Wood Mackenzie’s latest market outlook prediction that global wind generation capacity will surpass 1TW later this year. The report predicts Europe and China will account for 81% of the growth in offshore capacity over the next 10 years with China doubling capacity every year.

ESG slips down the priority list

ESG has become a bit of a political weapon in the US but even at the corporate level, its prominence is seemingly waning. A recent survey by The Harris Poll has seen ESG drop from the number one priority to number three among a group of 1,476 executives across 16 countries. Revenue growth and optimising client relationships have leapfrogged ESG. While 85% acknowledged the need to maintain strong sustainability credentials for their brands, 78% said they were having to do so with lower budgets. Fear of greenwashing was reported as a major concern and better measurement was cited as a contributor to executives’ worries.

Lessons from America - We can't make the same mistakes

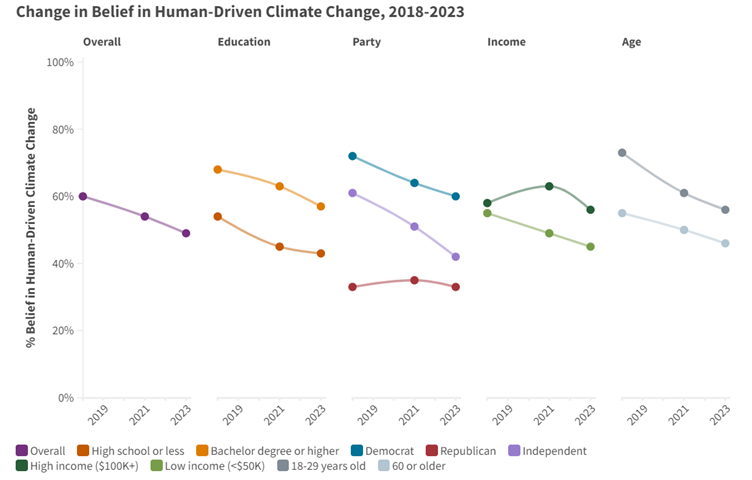

The latest survey on the US public’s attitude to climate change has just been released by the Energy Policy Institute at the University of Chicago. Alarmingly, it seems the number of US residents associating climate change with human activity is declining. While three quarters acknowledge climate change is real, the proportion believing it is caused by human activity has declined from 60% to 49% over the last five years. Equally challenging is that the number saying they are willing to pay for action is declining with 62% saying they were unwilling to pay US$1 more per month on their energy bills to address climate change. There is a strong lesson here about public information and accurate presentation of the facts.

Compressed air storage set for substantial growth

Among the many headlines on battery technologies and hydrogen, the storage potential of compressed air systems can easily be overlooked. Nevertheless, the global market for compressed air storage is predicted by Global Industry Analysts to grow five-fold over the next 8 years and reach US$22.5bn (NZ$36bn) by 2030. Renewable energy integration and grid optimisation are seen as the main drivers of the predicted growth.