Biomass can feedstock chemical sector at scale, competitive hydrogen and electric socks

In this issue:

Global collaboration on the increase

Despite as many road spikes as possible being cast by the US, it seems international collaboration on climate action is increasing. That’s the conclusion of the WEF’s Global Collaboration Barometer 2026. Specifically relating to climate, collaboration was up for cross-border trade in items such as renewables, electric transport, hydrogen and carbon capture and for climate financing. Although, in climate financing, while collaboration in financing mitigation was up, that directed towards adaptation was down.

For those that missed it, last month President Trump ordered the withdrawal of the US from 66 international organisations, many of which are climate related, including the UN Framework Convention on Climate Change (UNFCC) and the Intergovernmental Panel on Climate Change (IPCC).

Competitive hydrogen

Progress towards competitively priced green hydrogen has taken another step forward with a team of Chinese scientists from the China Agricultural University and Nanyang Technological University claiming they can produce green hydrogen at just US$1.54 ($2.54) a kilo. The trick is replacing the most wasteful part of the water-splitting process by using agricultural waste rather than water. The new process produces a valuable by product, formate but most importantly uses significantly less electricity, which is where the bulk of the savings materialise.

AI energy demand drives investment

Climate venture investment rose 8% in 2025 with much of the interest driven by solutions for rising AI energy demand. This was the first year of increase since 2022 with investment in climate ventures hitting US$40billion (NZ$66bn) for the year. The year saw a shift away from emissions reduction towards clean generation and while the amount invested grew, the number of deals fell 18%, indicating fewer, bigger projects receiving funding. Climate investment in the built environment increased 23%, with data centre developments being the cause. Deals related to grid developments and nuclear generation pushed energy sector investment up 31%.

Carbon credits lifting their game

Carbon credit rating agency BeZero’s analysis of the voluntary carbon market in 2025 shows quality is becoming increasingly important to buyers. The proportion of A (or higher) rated credits surrendered has more than doubled since 2022 as organisations run scared of greenwashing accusations. Because of quality concerns and shifting demand, total credit issuance has dropped 50% over the same period.

Negative prices hit record in Europe

The growth of renewables brings with it the prospect of negative power prices and the number of negative-price hours hit record highs across Europe in 2025. Germany, Sweden, Spain, France, Belgium and the Netherlands all saw more than 500 hours of negative prices. While negative prices sound great, they do increase price volatility and have material implications for generators, investors and PPAs, which could curb much needed investment.

Bless their little cotton (generating) socks

Scientists in China have generated electricity from cotton although, arguably, have cheated a little by using coated cotton. The cotton is half coated with pyrrole monomers that absorb incoming light and half with an alkaline dopamine that stores more moisture (from the air or perspiration) producing a thermal contrast and different rates of evaporation. The temperature differential causes ions to flow through microchannels in the cotton generating electricity. The material generates day and night, albeit at different rates, and is able to power small devices continuously.

Did you know ……

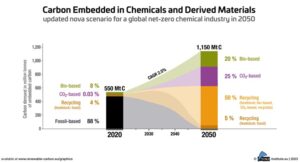

Agricultural and woody biomass could meet 20% of global carbon demand of the chemical and derived materials industries by 2050 without impacting food supply chains. A report by the Biobased Consortium and Renewable Carbon Initiative concludes that a net zero chemical industry in 2050 could be founded on carbon derived from biomass (22%), carbon capture (33%), recycling (20%) and a fossil remainder (24%). The research developed several scenarios, which included one with negligible fossil input.